My previous blogs have discussed individual asset bubbles and their impact on the economy. But what if there’s something bigger on the horizon? What if there’s an all-encompassing, all-growing bubble? And what if that bubble is on the verge of popping? Let me present: The Everything Bubble.

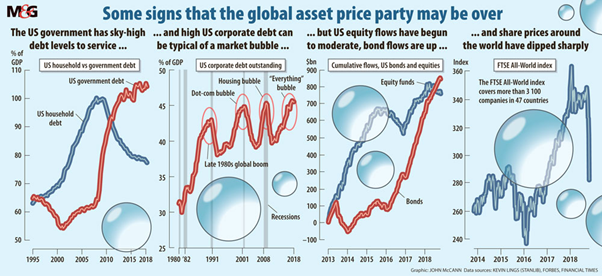

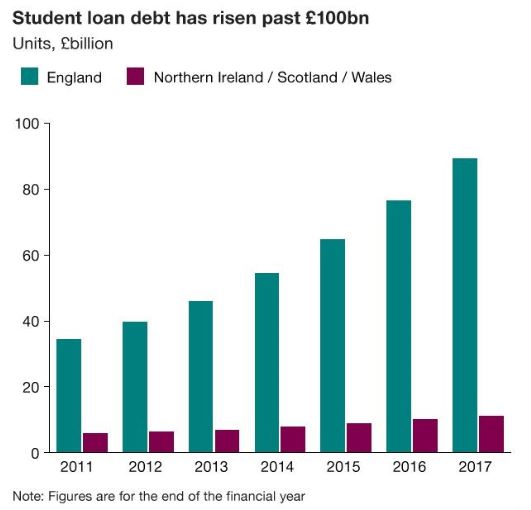

First coined in 2015, the “everything bubble” is an economic bubble of all major asset classes. In the US, it includes the rising student, national and corporate debt (Mauldin’s info-graphic depicts the inter-linking elements that make up this bubble). Financial analyst Jesse Felder suggests the cause of this bubble is that everything is overvalued; prices in the stock market, housing market and even in distinctive collectible markets have sky-rocketed to epic proportions. Everything appears to be in a bull market.

Similarly, Jesse Colombo makes reference to the Wall Street stock bubble being led by FAANG (Facebook, Apple, Amazon, Netflix and Google). Since 2009, these companies have projected figures upwards of 1000%, with Netflix seeing the biggest growth of over 6000%.

For years the solution to these rising problems in the economy have been two things: the policy of creating trillions in new currency and buying trillions in assets. As a result, Federal borrowing has now reached $1.2 trillion.

With cheap interest rates readily available, it has allowed ‘passive investors’ to enter the stock market. This has caused stocks to rise and prices to surge. It parallels the Federal Reserve attempts in 1995, where they felt compelled to oversupply the economy with near zero interest-rates; they believed this could enable strong economic growth in the future. The only thing it did enable was the dot-com crash of 2000 and the housing crash of 2007. As this present-day debt spirals, surely it won’t be long till we see the third major crash.

Looking beyond the US also makes for bleak reading. China is currently experiencing an explosive debt bomb, which has huge global implications. Similarly, with the debt and ongoing trade war between the two countries, it means that any sort of financial bailout looks increasingly improbable.

As I have seen from my previous blogs, this bubble is experiencing similar trends of the past. The term “history repeats itself” seems apt here to describe bubbles. Humans will always create bubbles through speculation and greed – cheap finance fuels this to the point where the government can no longer postpone the popping.

My take on bubbles? Widely inflated prices will always drop, the bubble will always burst and history will always repeat itself.

Rest assured the pop is coming and it certainly won’t be a pretty sight when it does….